Still sending invoices as PDFs via email — without Peppol? Your customer may soon have every right to reject them. Legally.

Starting January 1, 2026, electronic invoicing via Peppol becomes mandatory in Belgium. Yes, it’s a legal requirement — but if that’s all you see, you’re missing the bigger opportunity. For many wholesalers and manufacturers, Peppol is a chance to reduce manual work, automate more processes, and streamline administration.

Peppol, in plain English

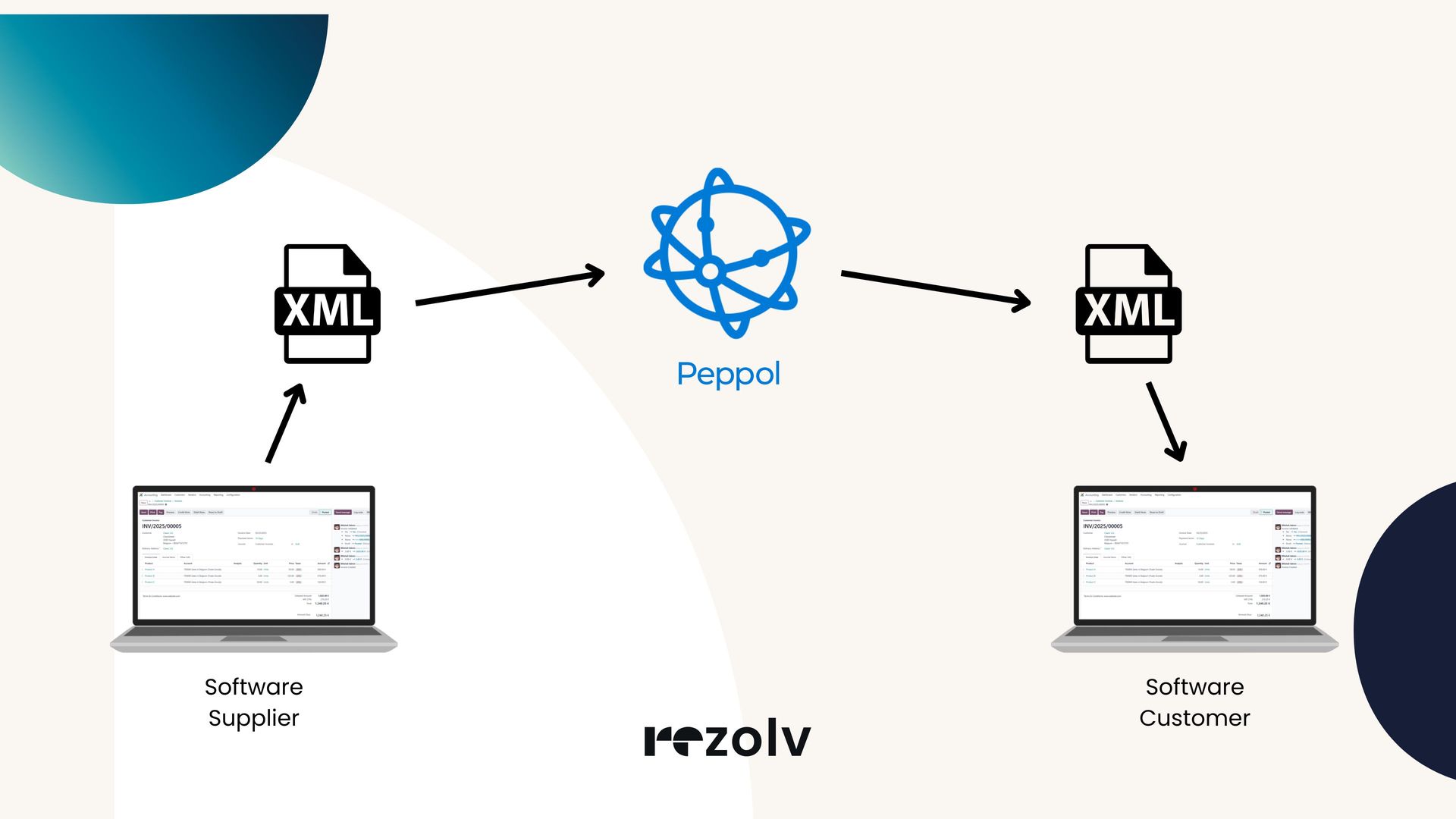

Peppol (Pan-European Public Procurement Online) is an international network that allows you to send electronic documents — such as e-invoices — securely and using a standardized format. Because these are structured files, they can be processed automatically by the recipient’s software. No more manual data entry.

Still sounds abstract? Let’s break it down.

Instead of emailing a PDF invoice (or printing and mailing it), Peppol converts your invoice into an XML file — a digital format that accounting systems can read and process instantly.

That means you no longer need to enter invoices by hand or rely on OCR software. No retyping, no human errors. The invoice arrives fully structured and ready to book in your customer’s system — and the same applies when you receive invoices from your suppliers.

Think of Peppol as a secure digital highway between your software and that of your customers or vendors.

From January 1, 2026, using that highway becomes mandatory for all B2B transactions between VAT-registered companies in Belgium. And the consequences are real: if you only send a PDF, you won’t be compliant — and you may face rejected payments or even fines. From that point on, only structured e-invoices sent via Peppol will be legally accepted.

Less work, Fewer mistakes

For many wholesalers and manufacturers, invoice processing is still a slow and error-prone task. Incoming invoices are often typed over manually or scanned via OCR, which increases the risk of errors. Outgoing invoices are usually emailed as PDFs — which works, but isn’t exactly efficient.

With Peppol, you eliminate those manual steps. You work with structured XML files that are processed automatically. Data enters your system in real time — without errors, and ready for action.

The result?

- Faster invoice processing

- Fewer mistakes and duplicated effort

- More time for your finance team to focus on strategic work

In industries with high invoice volumes — like wholesale — that kind of automation makes a huge difference. You scale your processing capacity without adding headcount. And in today’s labor market, that’s more relevant than ever.

How to get started?

Peppol makes sense. It’s efficient, secure, and future-proof. But how do you get started?

The good news: using Peppol is free. The network itself is publicly accessible, and there are no fees for sending or receiving e-invoices.

What you do need is an Access Point — a secure connection that sends and receives invoices via the Peppol network. Many businesses already use software that supports this. But is your system Peppol-ready? And do you know what steps are still needed?

Bonus tip: implementation costs related to Peppol — like software adjustments — are eligible for a 120% tax deduction in Belgium (until 2027). So digitalising your invoicing process isn’t just smarter. It’s also financially attractive.

Are you ready for Peppol?

2026 will be here before you know it. But is your business ready?

Is your system Peppol-compatible? Are your settings correctly configured? Have you already tested sending an invoice via Peppol?

Software vendors and implementation partners are already seeing rising demand for Peppol integrations. The pressure is building — and timelines are getting tighter. Wait too long, and you may find yourself stuck at the back of the queue.

The shift to Peppol is mandatory. But whether you fall behind or take the lead — that’s a choice you make today.

What will you choose?

PEPPOL IS...

- Legally required from 2026

- A secure and standardized way to exchange invoices

- Eligible for 120% tax deduction (in Belgium)

- The end of manual data entry and OCR mistakes

- Something worth starting today, not tomorrow

- A chance to future-proof your invoicing and administration